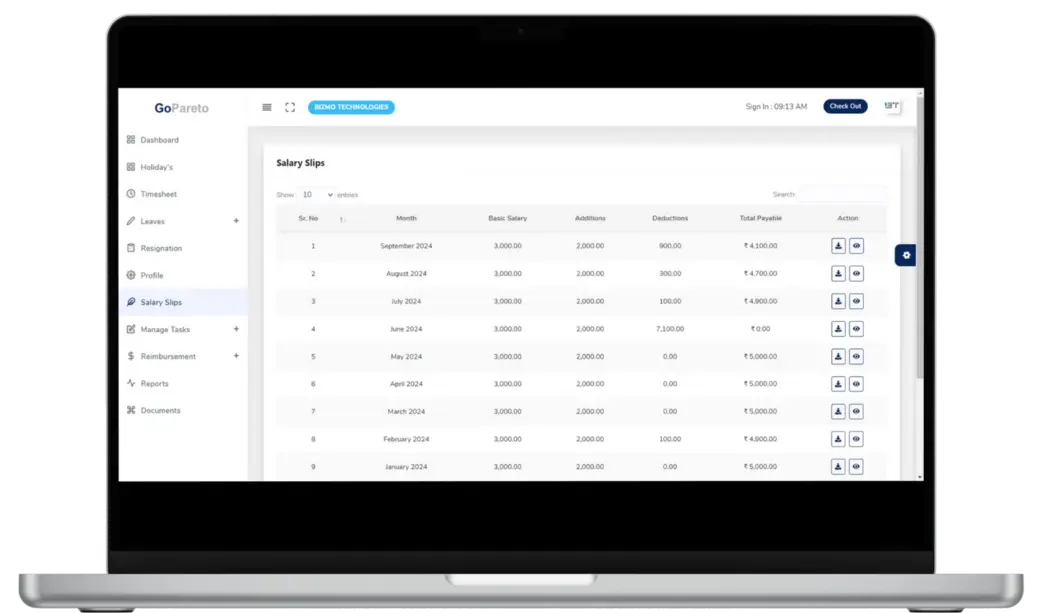

Clear, Compliant, and Transparent Payslips

A payslip is more than just a document. It’s proof of earnings, a record of deductions, and a transparent breakdown of how an employee’s pay is calculated. Payslips in India assist workers in comprehending all aspects of their income, including net take-home pay, statutory deductions, and gross pay. They are crucial to employee trust, compliance, and HR transparency.

At Gopareto, we provide payslip sample formats that reflect how modern Indian organisations operate and help HR teams deliver clarity with every payroll cycle. With the help of payslips, employees can verify their earnings, allowances, tax deductions and statutory contributions.

What Is a Payslip Sample

A payslip sample in India shows the typical structure of a salary statement. It includes:

Employee Details

Name, employee code, department

Pay Components

Basic salary, house rent allowance, special allowance

Deductions

Income tax, provident fund, professional tax

Net Pay

Amount payable to the employee after deductions

This sample is a reference that helps HR professionals create consistent, compliant, and transparent payslips each pay cycle.

Why Payslips Matter in India

Whether for loans, visa processes or personal records, a payslip in India is often required as official proof of income.

How Electronic Payslips Help Modern Businesses

Digital payslips streamline the payroll process and reduce manual effort. With a system like Gopareto’s Automatic Payslip Generation:

Automated generation

Payslips are generated automatically based on defined pay rules.

Fewer errors

Calculation mistakes are minimised with rule-based computation.

Secure delivery

Deliver via email or portal with controlled access.

Preserved history

Historical records are stored securely online.

This digital approach saves time for HR teams and adds transparency for employees.

What a Typical Payslip Sample Includes

A complete payslip sample for India often shows:

Earnings Section

Deductions Section

Net Salary

This is the amount the employee receives after all deductions. Clear formatting helps employees see everything in one place.

Benefits of a Standardised Payslip Sample

Uniform presentation

Consistent layout across teams improves clarity.

Fewer processing errors

Standard formats reduce mistakes in payroll.

Clear components

Salary elements are communicated cleanly.

Faster statutory reports

Structured data speeds compliance reporting.

Standardised payslip formats also help auditors and compliance teams verify payroll quickly and accurately.

Creating Payslips for Different Employee Types

A flexible payslip sample covers all these scenarios with proper earning and deduction entries so every employee gets a clear salary statement.

Payslip Delivery and Access

This flexibility ensures employees can view and save payslips easily whenever needed.

How Gopareto’s Payroll Automation Enhances Payslip Accuracy

Gopareto’s Automatic Payslip Generation does more than just create payslips. It:

This reduces manual workload for HR teams and gives employees confidence in their payroll information.