Make Payroll Accurate, Fast, and Compliant

Management of payroll in India can be challenging. For HR and finance departments, varied compensation structures, legal requirements, tax law compliance and deadlines add layers of work. Spreadsheets, siloed records and manual computation slow down the process and raise the possibility of mistakes. To operate confidently, accuracy and compliance are essential for organisations of all sizes.

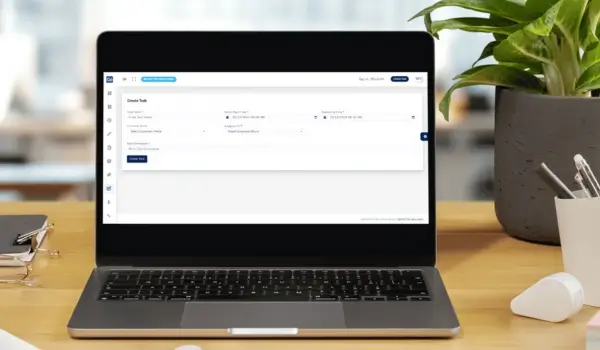

Our Cloud-based payroll system in India is built around these essential needs. It brings payroll processes onto a secure platform with automation at every step, from salary computation to payslip delivery and compliance reporting.

These challenges affect internal resources and reporting, and impact employee satisfaction. A cloud-based payroll system in India eliminates these hurdles and returns attention to strategic HR work.

Payroll Challenges in Indian Businesses

Many HR teams still depend on manual or semi-automated methods for payroll, which leads to predictable problems:

These challenges affect internal resources and reporting, and impact employee satisfaction. A cloud-based payroll system in India eliminates these hurdles and returns attention to strategic HR work.

What Our Cloud-Based Payroll System Offers

A modern payroll system in India should free your team from repetitive and error-prone work. Here’s how our solution delivers practical value:

Automated Salary Computation

Calculations for earnings, deductions, bonuses, and statutory contributions happen automatically based on predefined rules. This accuracy removes guesswork and manual workload.

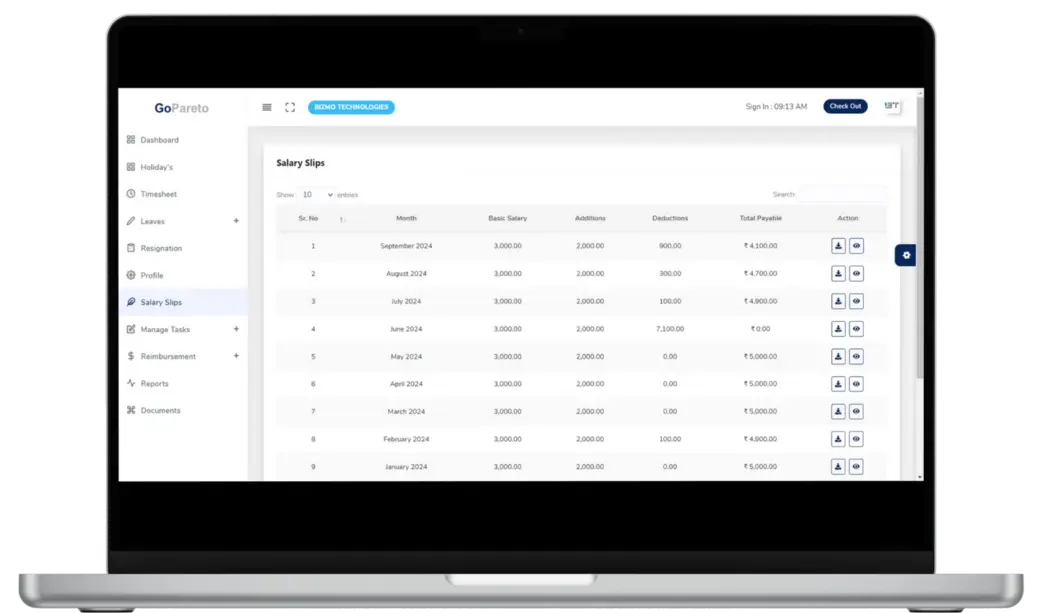

Automatic Payslip Generation

Digital payslips are generated each pay cycle and can be shared with employees instantly. This not only saves time but also provides transparent records for every salary component.

Statutory Compliance and Tax Handling

The system integrates updated tax parameters and statutory rules so payroll calculations comply with current Indian regulations, reducing the risk of penalties.

Integration with Attendance and Timesheets

Payroll pulls attendance and timesheet data directly when you integrate those systems. This keeps working hours, overtime, and leave adjustments aligned with payroll.

Key Features That Support Smooth Payroll Operations

Our cloud payroll system ensures every function works together to simplify your process:

- Centralised Employee Data — All payroll-related data lives in one secure place. No more scattered files or version mismatches.

- Secure Cloud Access — HR teams and authorised managers can access the system from anywhere, with data protected by enterprise-grade security.

- Tax Compliance Updates — Stay aligned with the latest tax rules without manual intervention in yearly updates.

- Automated Statutory Reports — Generate compliance reports quickly, with accurate calculations for PF, ESI and other contributions.

- Custom Pay Elements — Support for different pay components such as allowances, bonuses, reimbursements and deductions based on organisation policy.

Benefits HR and Finance Teams Will Value

Here are ways this solution adds real value:

Reduce Administrative Effort

Automate repetitive tasks and save time every cycle.

Increase Accuracy

Rule-based calculations reduce manual errors.

Faster Payslip Delivery

Generate and share payslips instantly.

Improved Compliance Assurance

Stay aligned with tax and statutory rules.

Real-Time Insights

Dashboards provide visibility into payroll trends.

Automating core payroll tasks frees your team from repetitive work and reduces manual errors. With automated computation and compliance rules, payroll results are more reliable and consistent. Payslips are generated and shared digitally every pay cycle without manual formatting or distribution. The system tracks statutory requirements and tax rules, helping you stay aligned with Indian payroll regulations. Dashboards and reports give visibility into payroll costs, tax liabilities and pay trends across the organisation.

How Implementation Works

We follow a structured rollout so your team sees results quickly:

This structured rollout means your team can begin seeing results quickly with minimal disruption.

What Users Experience

Employees receive timely, accurate payslips and HR teams spend less time fixing errors or reconciling spreadsheets. Business leaders gain confidence from reliable payroll data and simpler reporting.

Supporting Your Growth as You Scale

The payroll system expands along with your company's needs. The platform easily adjusts as you add new sites, hire contract or remote staff, or change pay arrangements. Payroll is flexible and able to accommodate future growth thanks to cloud access, which guarantees data flows safely between teams.

Make Payroll a Strength, Not a Burden

One of the most crucial tasks in any organization is payroll. It has an impact on operational effectiveness, compliance, and employee trust. In India, a contemporary cloud-based payroll system turns payroll from a laborious, manual procedure that is prone to errors into a reliable, automated one. This payroll solution is made to provide results you can rely on each pay cycle if your company wants to decrease burden, increase accuracy, and maintain compliance with changing rules.