Automated Payroll Built for Pune Businesses

It might be difficult to manage payroll in Pune's demanding business environment. A dependable payroll process is necessary due to statutory deductions, variable allowances, dynamic work hours, and compliance requirements. Manual methods or scattered spreadsheets slow teams down and introduce unnecessary errors. Pune businesses need a solution that automates and simplifies payroll with consistency.

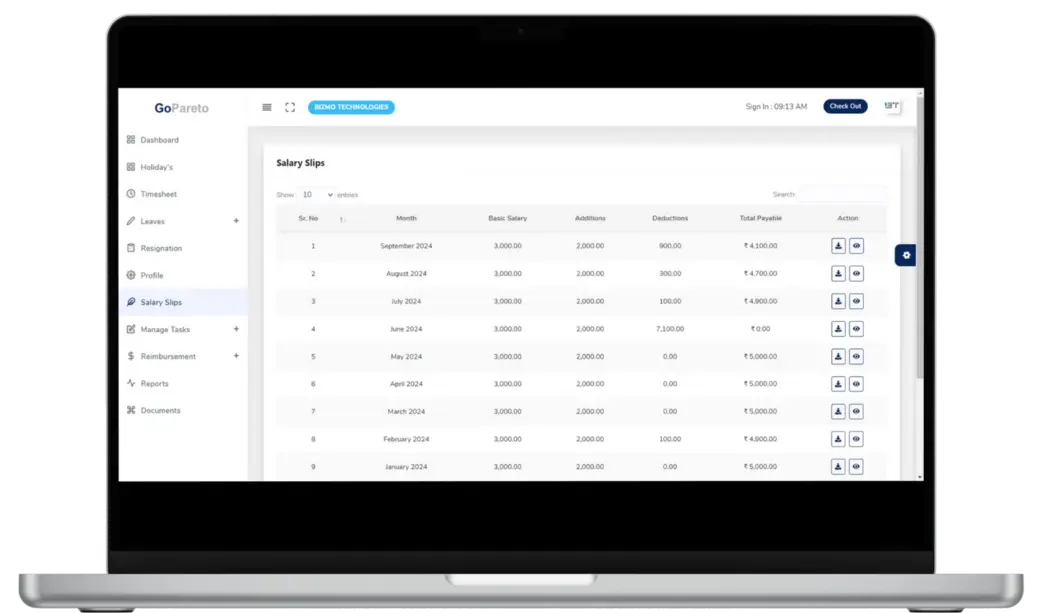

Our Payroll software Pune delivers exactly that. Every pay cycle, it produces precise results, guarantees adherence to Indian legal regulations, and automates calculation. HR and finance professionals may concentrate on strategic work instead of tedious paperwork thanks to cloud access and integrated functionality. Gopareto's payroll solution, which includes seamless record management and automated payslip creation, improves salary processing efficiency, accuracy, and transparency.

Why Automated Payroll Matters in Pune

Payroll processing involves more than simple arithmetic. In Pune, companies of all sizes deal with multiple pay structures, attendance variations, allowances, deductions, taxes, and regulatory compliance. Manual systems often lead to:

Cloud-based payroll software removes these obstacles by processing data automatically, aligning with current laws, and reducing time spent on repetitive tasks. Gopareto’s system streamlines this with built-in compliance, clear pay records, and automated payslip creation.

Core Benefits of Payroll Software in Pune

Precise Salary Calculations

Automatically computes salaries, allowances, deductions and net pay reliably.

Automatic Payslip Creation

Generates payslips without manual formatting or distribution.

Regulatory Compliance

Reflects current tax and statutory rules in payroll.

Centralised Records

Secure cloud data for easy access and reporting.

Mobile & Remote Access

Manage payroll anytime, anywhere with cloud support.

Key Features that Support Payroll in Pune

Employee Master Data

Manage employee profiles, components and policies centrally.

Attendance & Timesheets

Integrate attendance and time data for accurate payroll.

Tax & Statutory

Apply compliance rules automatically for every cycle.

Payslips & Distribution

Generate and share professional payslips digitally.

Dashboards & Reports

Gain visibility into costs, history and trends.

When combined, these capabilities boost visibility into payroll expenditures and history, decrease manual labor, and improve accuracy.

How it Works for Pune Organisations

The system works seamlessly with standard business needs. HR teams import employee data, define pay policies, connect attendance and leave records, and then let the system do the rest. At each pay cycle:

This workflow frees time for HR and finance professionals to focus on strategy instead of manual tasks.

Advantages for HR and Finance Teams

Fewer payroll errors

Automations reduce manual mistakes across cycles.

Faster processing

Streamlined workflows speed up pay runs.

Digital payslip delivery

Share payslips instantly and securely.

Better audit trails

Track changes and approvals with clarity.

Compliance visibility

Monitor statutory adherence confidently.

The result is a more predictable and controlled payroll function that enhances employee satisfaction and keeps your team focused on growth.

Cloud Capability for Modern Business Needs

Cloud platforms like Gopareto’s enable secure, anytime access and modern payroll automation.

Support Through Implementation and Beyond

This approach helps companies transition smoothly and see results quickly.

What Users Experience After Adoption

Employees also benefit from timely, accurate payments and easy access to payroll records.